Dan Melson: May 2009 Archives

Last makeup week. Let's hope I don't let this get behind again!

Newly Written Articles

You Want an Agency That Can Pay ENOUGH Attention to YOU: Just because they sell a lot of properties doesn't mean they do a good job of it. More and more, that is the complete opposite of the way things really are.

Restricted Sale Property: Very Difficult to Find A Loan If your property has restrictions upon who you can sell it to (as low income housing, college housing endowments and other properties often have) then lenders will usually not be willing to loan against the property.

Buying Real Estate Isn't Simple. You've got hundreds of thousands of dollars on the line. People are going to try to cheat. Complex issues requiring professional knowledge really do pop up. If it were easy, anyone could do it without problems. Clearly, with the number of people having problems right now, that is not the case.

Student Loans and Real Estate Loans: Default, Repayment vs. Nonpayment and Consolidation Effects student loans have on your ability to afford real estate loans - even when you're not in repayment status.

Debunking the "Record Wave of Foreclosures Coming" Myth This is just manipulating data to make things look worse than they are.

The Measurement Unit For Desirability Is Dollars A good buyer's agent can make a difference, but if you want a property with something extra, you can expect to pay more for it than you would for a property without that extra.

I'm Competing Against Multiple Offers. How Do I Proceed?

Consumer Focused Carnival of Real Estate the once a month roundup of worthy articles submitted for consideration

Updated Articles

Why the Real Estate Buyers Agent's Commission is Paid by the Seller

What Can You Recover From the Title Company When They Miss an Easement?

Efforts to Rehabilitate the Negative Amortization Loan

Can Someone Be Added to an Existing Mortgage?

Buying Investment Property - An Example of the Issues

Practical Examples - Refinance or Prepayment Penalty?

Power of Attorney for Real Estate Transactions

The Seller Always Knows More About the Property Than the Buyer

Full Circle: Back to More Traditional Lending Standards

The "We'll Keep You In Your Property" Scam

Investors Aren't The Only Ones Who Can Fix Ugly Properties

What if Your Partner Refuses to Pay Their Share of a Loan or Mortgage (or Won't Pay on Time)?

Cash Back From The Seller to the Buyer in Real Estate Sales The only reason people want to do this is to commit FRAUD

Once per month, I link the best articles that are submitted containing information for the consumer. May 2009 Consumer Focused Carnival of Real Estate is now live.

This is the new list of HOMESTEPS properties from Freddie Mac for the areas I specialize in. These properties qualify for special financing. I can get the list for other areas.

I also have a list of upcoming HOMESTEPS properties not on the market yet

If you have questions, Contact me

La Mesa

Address: 4800 WILLIAMSBURG LN 223, LA MESA, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 185,500.00

El Cajon

Address: 1273 ANDOVER RD, EL CAJON, CA

Rooms: 5 Bed: 2 Bath: 1.0 Price: 223,130.00

Address: 1000 SOUTH MOLLISON 19, EL CAJON, CA

Rooms: 5 Bed: 2 Bath: 2.0 Price: 118,455.00

Address: 622 TAFT AVENUE, EL CAJON, CA

Rooms: 5 Bed: 3 Bath: 1.0 Price: 206,700.00

Address: 792 N MOLLISON 1, EL CAJON, CA

Rooms: 5 Bed: 2 Bath: 2.0 Price: 108,650.00

Lakeside

Address: 12923 MAPLEVIEW ST, LAKESIDE, CA

Rooms: 4 Bed: 2 Bath: 1.0 Price: 63,500.00

Santee

Address: 9139 FANITA RANCHO ROAD, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 1.0 Price: 206,700.00

Address: 7390 OLD MISSION COURT 169, SANTEE, CA

Rooms: 4 Bed: 2 Bath: 2.0 Price: 204,050.00

Address: 9635 MAST BOULEVARD, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 237,970.00

Address: 10507 FLORA AZALEA COURT, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 332,500.00

San Diego City

Dan Melson, Agent

Clarity Real Estate Network

619-300-7425

The Best Loans Right NOW

(based upon "average credit", not absolutely perfect credit. People who do have better credit get even better rates)

I do fear that rates have risen due to inflation fears and government spending. If you've been waiting to refinance for rates to hit bottom, treasury auctions aren't being very successful. I suggest you stop putting it off. In the last few days, I've gone from 4.75 without any points to 5.125 with a point on conforming 30 year fixed rate loans.

Conforming Rates

Thirty Year Fixed Rate Loans

5.125% 30 Year fixed rate loan, with one total point (discount plus origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $400,000 loan, Payment $2178, APR 5.255! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate loans as low as 4.25 percent (But you'd have to be crazy to pay that many points!)

5/1 Hybrid ARM Rates

5/1 ARMs have now fallen to levels below 30 year fixed by about a full percent!

4.00% 5/1 ARM, with one total point (discount plus origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $400,000 loan, Payment $1910, APR 4.121! This is a fully amortized thirty year loan with the interest rate fixed for five years. 5/1 ARM rates as low as 3.5 percent (But you'd have to be crazy to pay that many points!)

Jumbo Conforming Rates (aka Super Conforming)

(NOW $417,001 to $697,500 in San Diego))

5.25% 30 Year fixed rate loan, with one point (total discount and origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $500,000 loan, Payment $2761, APR 5.380! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate loans as low as 4.25 percent (But you'd have to be crazy to pay that many points!)

VA Rates

5.375% 30 Year fixed rate loan, with one total point (discount plus origination) from the lender to the consumer and NO PREPAYMENT PENALTIES (Standard Veterans Administration government generated charges to borrowers apply)!. Assuming a $400,000 loan, Payment $2240, APR 5.507! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate VA loans as low as 4.5 percent (But you'd have to be crazy to pay that many points!)

NONCONFORMING ("JUMBO") RATES

(NOW $697,501 and above in San Diego)

These numbers assume a 70% loan to value ratio, not 80.

Thirty Year Fixed Rate Loans

6.05% "Jumbo" 30 Year fixed rate loan, with ONE point total discount and origination, and NO PREPAYMENT PENALTIES!. Assuming a $700,000 loan, Payment $4219, APR 6.178! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! Jumbo 30 year fixed rate loans as low as 5.375 percent (But you'd have to be crazy to pay that many points!)

5/1 Hybrid ARM Rates

JUMBO 5/1s are a full percent lower than 30 year fixed

4.70% "Jumbo" 5/1 ARM, with one point total discount and origination, and NO PREPAYMENT PENALTIES!. Assuming a $700,000 loan, Payment $3630, APR 4.818! This is a fully amortized thirty year loan with the interest rate fixed for five years. 5/1 Jumbo ARMs as low as 3.75 percent (But you'd have to be crazy to pay that many points!) On the hypothetical $700,000 loan, a 5/1 saves over $780 per month in cost of interest over a thirty year fixed!

All rates above are intended for San Diego County today, and include a 30 day lock. Loan prices will vary every day. Loan pricing in the rest of California will be similar. Conforming loan pricing will be similar between about $150,000 and the conforming limit in your area. Nonconforming loan pricing will be similar from the conforming limit up to about $1 million dollars in loan amount.

10 year interest only payments available on 30 year fixed rate loans!

Great Rates on super-jumbo loans also available!

Zero closing costs and zero points loans also available!

Portfolio lenders! Need something special most lenders can't do? Portfolio lenders may be the key! I have portfolio lenders!

Yes, I still have low to zero down payment purchase and some stated income programs available!

These are actual retail rates at actual costs available to real people with average credit scores! I always guarantee the loan type, rate, and total cost as soon as I have enough information from you to lock the loan (subject to underwriting approval of the loan). I pay any difference, not you. If your loan provider doesn't do this, you need a new loan provider!

All of the above loans are on approved credit, not all borrowers will qualify, based upon an 80% loan to value and a median credit score on a full documentation loan. Rates subject to change until rate lock.

Interest only, stated income, bad credit and other options also available. If you need a mortgage, chances are I can do it faster and on better terms than you'll actually get from anyone else in the business.

Designing transactions for low to zero down payment a specialty

Please ask me about first time buyer programs, including the Mortgage Credit Certificate, which gives you a tax credit for mortgage interest, and can be combined with any of the above loans!

Ask about the 105% refinance with no PMI

Call me. Clarion Mortgage Capital at 619-300-7425, ask for Dan. Or email me: danmelson (at) danmelson (dot) com

The new consumer article for today is I'm Competing Against Multiple Offers. How Do I Proceed?. It's an article directed at consumers, not real estate professionals, so it doesn't go over some things such as alternatives to money that are context sensitive, but it does give a solid overview of the issues you should be considering.

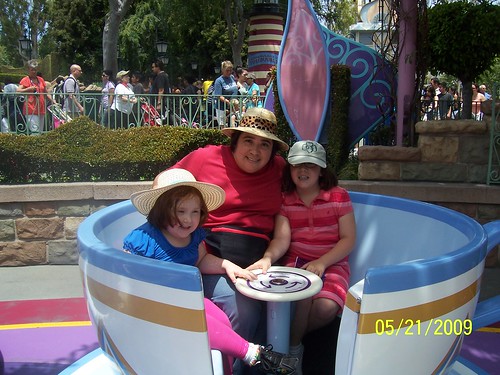

Just so you know why I haven't written new articles over this weekend, here is my trip report. Didn't take a huge number of pictures - mostly we were busy having fun.

The World's Only Perfect Woman and our kids in front of the Matterhorn. Ramona loved it last time. This time, not so much. Brynhilde liked it.

The Teacups - before the ride.

Main Street Station from the train. If you don't understand how important the train is to a successful day there, have someone explain it to you

Ramona loved King Arthur's Carousel. It's the World's Only Perfect Woman's favorite ride

Our little engineer. She's got disassembly down pat. Be very afraid.

I just think King Arthur's Carousel looks cool at night.

My driver on Mr. Toad's Wild Ride. Brynhilde's first drive. Mr. Toad never had it so good!

The other half of the family party - Ramona was starting to fade, nap or no

Just after riding Grizzly Rapids the next day. The water was cold, but it was nice after the immediate shock wore off.

My kids with some random unimportant stranger on the Zephyr ride

Ramona, fresh out of crawling over the water faucet in Bug's Life, in line for the Ferris Wheel. She really wanted to ride bad - "They won't let us in!"

Brynhilde, suitably bored in line for the Ferris Wheel.

I've spent the time since recuperating. It's what you need to do when you're an old fat guy who takes young kids to an amusement park for two consecutive days.

I hope to have time and energy to finish an article for Wednesday publication tomorrow. But tomorrow It's going to be a reprint. I would rather it weren't so, but sometimes a guy's gotta do what a guy's gotta do.

I've been letting this slide for several weeks due to one thing or another, during which time I've done a few important new articles and republished quite a few important older ones. Therefore, I'm going to limit the review to three weeks and do so more catch up next time.

Newly Written Articles

Shopping For The Best Loan In The New Lending Environment discusses the differences that the new appraisal standards and lender's preferential treatment of their own captive loan officers have made in shopping for a loan.

State of the La Mesa and East County Real Estate Market April 2009

105% Refinancing With No PMI (Maybe) discusses the new loan programs from Fannie Mae and Freddie Mac intended to keep them from losing money they don't have to.

Consumer Focused Carnival of Real Estate once per month I link to the good stuff submitted from other sites.

Updated Articles

Variable or Range Pricing of Real Estate discusses what variable pricing does, and what it does not do.

There's Nothing Sacred About Asking Price in Real Estate - Variable Range or Regular talks about the fact that just because you put a certain asking price on a property doesn't mean people will offer that.

Down Payment At Purchase or Wait Until Later To Pay The Mortgage Down?

Good Intentions and Over-Extended Homeowners discusses how well-intentioned efforts to help people can end up hurting far more people far worse than if we had simply let events run their course.

Loans with Stealth "Cash Out": Loan originators using your money to make it appear that the costs are lower than they are.

Refinancing Out of A Negative Amortization Loan (Or Any Other) Before The Penalty Expires talks about the math of whether such a thing is in your best interest or not.

100% Financing or Low Down Payment or Low Equity: PMI May Be The Only Option Splitting your loan amount into two pieces is generally more desirable than a single loan when you have less than 20% equity. Unfortunately, it's very hard to get second mortgages in such circumstances currently.

Listing Agents Claiming There Are Multiple Offers and other background noise.

What Do Buyer's Agents Do? a basic primer on reasons why you want a buyer's agent - preferably before you start looking.

When Your Offer is Rejected What now?

Should Lenders Be Permitted to Sell Real Estate? A philosophical piece. It's not the tollbooth I'm selling; it's the expertise.

Realtor and Loan Officer Responsibility: Can the Client Afford The Property? If they can't, don't sell it to them. Find something else they can afford.

Will Agents List My Property if I Owe More Than It's Worth? The answer is "yes"

Recording Errors and Title Insurance

Inducements to Use A Builder's Lender for a Purchase Sometimes it actually makes sense, if they offer something others won't.

Saving Money by Refinancing Your Mortgage Make certain you are actually saving money

Low Equity (or Worse!) Relocations in a Buyer's Market How to bring this off and leave yourself in the best situation possible.

This is the new list of HOMESTEPS properties from Freddie Mac for the areas I specialize in. These properties qualify for special financing. I can get the list for other areas.

I also have a list of upcoming HOMESTEPS properties not on the market yet

If you have questions, Contact me

La Mesa

Address: 4800 WILLIAMSBURG LN 223, LA MESA, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 185,500.00

Address: 3920 MASSACHUSETTS AVE, LA MESA, CA

Rooms: 5 Bed: 2 Bath: 1.0 Price: 279,900.00

El Cajon

Address: 12074 CALLE DE LEON # 51, EL CAJON, CA

Rooms: 4 Bed: 2 Bath: 2.5 Price: 206,647.00

Address: 1273 ANDOVER RD, EL CAJON, CA

Rooms: 5 Bed: 2 Bath: 1.0 Price: 223,130.00

Address: 754 ALVEDA AVE, EL CAJON, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 268,180.00

Address: 622 TAFT AVENUE, EL CAJON, CA

Rooms: 5 Bed: 3 Bath: 1.0 Price: 206,700.00

Address: 792 N MOLLISON 1, EL CAJON, CA

Rooms: 5 Bed: 2 Bath: 2.0 Price: 108,650.00

Lakeside

Address: 9717 WINTERGARDENS BLVD192, LAKESIDE, CA

Rooms: 3 Bed: 1 Bath: 1.0 Price: 55,120.00

Address: 12923 MAPLEVIEW ST, LAKESIDE, CA

Rooms: 4 Bed: 2 Bath: 1.0 Price: 63,500.00

Santee

Address: 9139 FANITA RANCHO ROAD, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 1.0 Price: 206,700.00

Address: 7390 OLD MISSION COURT 169, SANTEE, CA

Rooms: 4 Bed: 2 Bath: 2.0 Price: 204,050.00

Address: 9635 MAST BOULEVARD, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 237,970.00

Address: 10507 FLORA AZALEA COURT, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 332,500.00

San Diego City

Address: 5252 ORANGE AVE 332, SAN DIEGO, CA

Rooms: 3 Bed: 1 Bath: 1.0 Price: 66,500.00

Dan Melson, Agent

Clarity Real Estate Network

619-300-7425

The Best Loans Right NOW

(based upon "average credit", not absolutely perfect credit. People who do have better credit get even better rates)

Conforming Rates

Thirty Year Fixed Rate Loans

4.75% 30 Year fixed rate loan, with NO points (discount or origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $400,000 loan, Payment $2087, APR 4.789! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate loans as low as 3.75 percent (But you'd have to be crazy to pay that many points!)

5/1 Hybrid ARM Rates

5/1 ARMs have now fallen to levels below 30 year fixed by about half a percent!

4.125% 5/1 ARM, with NO POINTS (discount or origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $400,000 loan, Payment $1939, APR 4.163! This is a fully amortized thirty year loan with the interest rate fixed for five years. 5/1 ARM rates as low as 2.625 percent (But you'd have to be crazy to pay that many points!)

Jumbo Conforming Rates (aka Super Conforming)

(NOW $417,001 to $697,500 in San Diego))

4.625% 30 Year fixed rate loan, with one point (total discount and origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $500,000 loan, Payment $2571, APR 4.750! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate loans as low as 3.875 percent (But you'd have to be crazy to pay that many points!)

VA Rates

5.00% 30 Year fixed rate loan, with NO points (total discount and origination) from the lender to the consumer and NO PREPAYMENT PENALTIES (Standard Veterans Administration government generated charges to borrowers apply)!. Assuming a $400,000 loan, Payment $2147, APR 5.040! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate VA loans as low as 4.25 percent (But you'd have to be crazy to pay that many points!)

NONCONFORMING ("JUMBO") RATES

(NOW $697,501 and above in San Diego)

These numbers assume a 70% loan to value ratio, not 80.

Thirty Year Fixed Rate Loans

5.625% "Jumbo" 30 Year fixed rate loan, with ONE point total discount and origination, and NO PREPAYMENT PENALTIES!. Assuming a $700,000 loan, Payment $4030, APR 5.750! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! Jumbo 30 year fixed rate loans as low as 4.625 percent (But you'd have to be crazy to pay that many points!)

5/1 Hybrid ARM Rates

JUMBO 5/1s are a full percent lower than 30 year fixed

4.75% "Jumbo" 5/1 ARM, with one point total discount and origination, and NO PREPAYMENT PENALTIES!. Assuming a $700,000 loan, Payment $3599, APR 4.743! This is a fully amortized thirty year loan with the interest rate fixed for five years. 5/1 Jumbo ARMs as low as 3.5 percent (But you'd have to be crazy to pay that many points!) On the hypothetical $700,000 loan, a 5/1 saves over $650 per month in cost of interest over a thirty year fixed!

All rates above are intended for San Diego County today, and include a 30 day lock. Loan prices will vary every day. Loan pricing in the rest of California will be similar. Conforming loan pricing will be similar between about $150,000 and the conforming limit in your area. Nonconforming loan pricing will be similar from the conforming limit up to about $1 million dollars in loan amount.

10 year interest only payments available on 30 year fixed rate loans!

Great Rates on super-jumbo loans also available!

Zero closing costs and zero points loans also available!

Portfolio lenders! Need something special most lenders can't do? Portfolio lenders may be the key! I have portfolio lenders!

Yes, I still have low to zero down payment purchase and some stated income programs available!

These are actual retail rates at actual costs available to real people with average credit scores! I always guarantee the loan type, rate, and total cost as soon as I have enough information from you to lock the loan (subject to underwriting approval of the loan). I pay any difference, not you. If your loan provider doesn't do this, you need a new loan provider!

All of the above loans are on approved credit, not all borrowers will qualify, based upon an 80% loan to value and a median credit score on a full documentation loan. Rates subject to change until rate lock.

Interest only, stated income, bad credit and other options also available. If you need a mortgage, chances are I can do it faster and on better terms than you'll actually get from anyone else in the business.

Designing transactions for low to zero down payment a specialty

Please ask me about first time buyer programs, including the Mortgage Credit Certificate, which gives you a tax credit for mortgage interest, and can be combined with any of the above loans!

Ask about the 105% refinance with no PMI

Call me. Clarion Mortgage Capital at 619-300-7425, ask for Dan. Or email me: danmelson (at) danmelson (dot) com

The new consumer article for today is The Measurement Unit For Desirability Is Dollars. It really is that simple. A good agent can make a difference, but a property that has more will cost more. It isn't rocket science, but it is easy to lose sight of.

Articles like this one:

Foreclosures: 'April was a shocker'

have gotten an awful lot of play in the media these last couple weeks.

Here's what they're not telling you - or not explaining why it's important: This particular article actually mentions it in passing "That's due, according to Saccacio, to the many legislative and company moratoriums that have prevented the foreclosure process from starting on delinquent loans." However, they don't really explain what it means. Yes, Virginia, there was a moratorium on foreclosures in effect. Actually, there were several, some voluntary, most not. Most were related to what happened when Fannie Mae and Freddie Mac were taken over by the federal government last year, and one of the conditions was a moratorium on foreclosures for six months. These days, Fannie and Freddie hold just about every sort of mortgage paper there is except "hard money." Everything from the bluest chip mortgage given to people with immaculate credit, a huge down payment, and three times the income they needed down to the iffiest subprime loans ever. So when the moratorium on foreclosures hit, it cut a broad swath through the market, slowing down the process and delaying it by months for absolutely no improvements from the borrower. Didn't matter how many payments they missed; there was a moratorium on foreclosures in effect. Many of these borrowers took full advantage of this and several miles beyond; they didn't send a single dollar in for those months. This didn't help their situation any.

(How Fannie and Freddie got so deep into subprime, which was never their mandate and in fact was supposedly forbidden them by their charters, is a story guaranteed to make you hate Congress, and particularly, certain members of Congress, if you research it. After all, it's your taxpayer dollars that are going to make good the bad debts those clowns got them into, short-circuiting, obstructing and frustrating the regulatory oversight that was in place.)

So when that moratorium expired during March, Fannie and Freddie started moving forward on foreclosures that had been delayed six months or more, it took them a while to get up to speed. March was way up, but April was even more up. Shouldn't be a surprise. When a logjam breaks, there's going to be an abnormally high amount of water (and logs) going downstream for a while until the backlog gets dealt with. Those borrowers that just skated on what they thought was good fortune were the first ones in for a rude awakening.

Look at what they're telling you: "filings inched up 1% from March and rose 32% compared to April 2008." April 2008 wasn't just after a months-long foreclosure moratorium was lifted. It's a rotten, intentionally misleading comparison without that datum. They weren't going gaga over the drop in foreclosures in other months. I remember reports - buried deep in the "who cares" middle of the financial pages. Average out the numbers over the months the moratorium was in effect, and we're actually seeing a statistically significant decline in average foreclosure activity.

There is good news in the background. First, in the past six months, lenders have finally gotten serious about mortgage loan modification. No, they're not writing off grievous amounts of principal for everyone who asks. That's actually quite rare, and correctly so. But for borrowers making a serious effort and who can maybe kind of afford the properties they bought, the lenders are modifying interest rates downward for long periods of time - more than enough to permit the markets to recover, and long enough to prevent a future huge wave of foreclosures from hitting all at once.

Second, there's a minor but still helpful group of programs now being used to refinance people who formerly couldn't refinance: Both Fannie and Freddie now have programs offering up to 105% refinancing (maybe) without PMI in effect. For those who were otherwise able to finance, but prevented by deflating values, this is all they need to make it good and be able to keep their property. Particularly with sub-5% loans available right now.

Neither of these covers everybody, nor do both of them together. Nor do they help those who went the most overboard in terms of seeking out new and innovative financing forms, to paraphrase Star Trek. But they don't have to cover everyone. All they have to do is make enough of a dent in the future foreclosure market to keep the markets from being foreclosure saturated. Both of them are taking huge chunks out of the short sale market already. People don't (or shouldn't) do a short sale if they have another option, and these alternatives give a large number of people those other options.

We're not out of the woods yet; particularly not if the federal government persists in the sort of undesirable meddling in the markets they've been doing way too much of for the last year. But absent that interference, the trees are definitely thinning out, especially in the markets that took off early, crashed early, and have economic reasons to drive their housing demand back to where it was a few years ago. San Diego is one such. I am certain there are others.

Caveat Emptor

The new consumer article for today is Student Loans and Real Estate Loans: Default, Repayment vs. Nonpayment and Consolidation. These are the three issues that are most common for loan applicants to run afould of.

I've been letting my weekly article review slide for several weeks due to one thing or another, during which time I've done a few important new articles and republished quite a few very important older ones. Therefore, I'm going to limit the review to three weeks and do so more catch up next time.

Newly Written Articles

Consumer Focused Carnival of Real Estate Once a month, I collect, talk about and link to consumer real estate articles.

Rental Fraud, Landlord Fraud, and Prospective Tenant Scams I don't have much to do with rental real estate, but this is a common fraud going around right now.

How Agents Should Respond To An Appraisal Below Purchase Price This is very important now with HVCC in effect.

Who Has A Legitimate Interest In A Real Estate Transaction? is a philosophy of real estate article, drawing a distinction between who has an interest worth the protection of others, and who's just working for a paycheck and therefore can walk away if they don't think they're getting a benefit.

Updated Articles

The Tradeoff between Rate and Cost in Real Estate Loans This is probably the aspect of mortgages least understood by consumers. You must understand this in order to understand mortgages.

Loan Providers Offering to Pay For The Appraisal is a reprint of an older article, and with HVCC in effect, not as important as previously. Note that there is a difference between offering to pay, and being required to pay.

Why Renting Really Is For Suckers (And What To Do About It) is an important article - understanding the difference a couple of years more renting is likely to make to your financial future.

The Good Faith Deposit for Real Estate talks about the earnest money a buyer puts into escrow.

Developers and Incentive Money to Use Their Lender talks about ways to manipulate this system for your advantage

Competing Offers From The Same Agent For The Same Property

Disasters and the Mortgage talks about some of the hard truths of loan contracts.

What if Your Partner Refuses to Pay Their Share of a Loan or Mortgage (or Won't Pay on Time)? Once you are in this situation, you may be forced to choose between bad alternatives. The time to protect yourself is before it happens.

Option ARM and Pick a Pay - Negative Amortization Loans These have been regulated out of existence, and for good reason. But they might come back, so you need to be aware of the problems with them.

Discovering You've Got A Bad Loan - Don't Panic! Making the best of a sub-prime situation

Listing Agents and Pre-Approvals or Pre-Qualifications Pre-Qualification and Pre-Approval are bad jokes foisted on the public by listing agents who don't understand loans but are trying to play CYA in case the transaction falls apart.

Negative Amortization Loans - More Unfortunate Details More problems with this horrible loan.

Negative Amortization Loan Issues on Investment Property There really were potentially useful niches for this loan. But it was horribly abused.

Option ARMs and Cash Flow debunking one of the standard agent and loan officer rationalizations for putting people into this awful loan.

Should Negative Amortization Loans Be Banned? I didn't think so. I thought the way to fight misapplication of these loans was to insist on full and complete disclosure - something that other loans can benefit from as well.

Loan Qualification Standards - Debt to Income Ratio The more important of the two key measures for loan qualification, for the consumer as well as the lender. This measures "Can you afford to pay it back?" and most of the reason for the meltdown was in playing games intended to frustrate this key measure of loan qualification.

Loan Qualification Standards - Loan to Value Ratio talks about the less important of the two key loan qualification metrics.

This is the new list of HOMESTEPS properties from Freddie Mac for the areas I specialize in. These properties qualify for special financing. I can get the list for other areas.

I also have a list of upcoming HOMESTEPS properties not on the market yet

If you have questions, Contact me

La Mesa

Address: 4800 WILLIAMSBURG LN 223, LA MESA, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 185,500.00

Address: 3920 MASSACHUSETTS AVE, LA MESA, CA

Rooms: 5 Bed: 2 Bath: 1.0 Price: 279,900.00

El Cajon

Address: 12074 CALLE DE LEON # 51, EL CAJON, CA

Rooms: 4 Bed: 2 Bath: 2.5 Price: 206,647.00

Address: 1273 ANDOVER RD, EL CAJON, CA

Rooms: 5 Bed: 2 Bath: 1.0 Price: 223,130.00

Address: 754 ALVEDA AVE, EL CAJON, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 268,180.00

Address: 470 EL MONTE RD, EL CAJON, CA

Rooms: 4 Bed: 2 Bath: 1.0 Price: 169,900.00

Lakeside

Address: 9717 WINTERGARDENS BLVD192, LAKESIDE, CA

Rooms: 3 Bed: 1 Bath: 1.0 Price: 55,120.00

Address: 12923 MAPLEVIEW ST, LAKESIDE, CA

Rooms: 4 Bed: 2 Bath: 1.0 Price: 63,500.00

Santee

Address: 9139 FANITA RANCHO ROAD, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 1.0 Price: 206,700.00

Address: 7390 OLD MISSION COURT 169, SANTEE, CA

Rooms: 4 Bed: 2 Bath: 2.0 Price: 204,050.00

Address: 10210 PALM GLEN DRIVE 73, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 2.5 Price: 237,440.00

Address: 10507 FLORA AZALEA COURT, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 332,500.00

San Diego City

Address: 5252 ORANGE AVE 332, SAN DIEGO, CA

Rooms: 3 Bed: 1 Bath: 1.0 Price: 66,500.00

Dan Melson, Agent

Clarity Real Estate Network

619-300-7425

Very interesting. Unprecedented even FHA Ok with Up Front Tax Credit or, in other words, using the tax credit money at closing.

We all want to enable FHA consumers to access the tax credit funds when they close on their home loans so that the cash can be used as a downpayment. So FHA will permit trusted FHA-approved lenders and HUD-approved nonprofits, as well as state and local governmental entities to "monetize" the tax credit through short-term bridge loans. We think the policy is a real win for everyone, ensuring that borrowers can tap into the numerous organizations that are already part of the FHA network to receive this additional benefit. FHA will be publishing the details shortly.

This isn't necessarily to say the lenders themselves will permit it - but it's fine with the FHA. I suspect the lenders are going to run with it, myself. The stumbling block in the past has always been that people with a tax credit coming don't necessarily get the money. Sometimes they have other debts, sometimes they have an unexpected tax liability. When that happens, there's a short that has to be repaid, creating a debt and usually payments, impacting debt to income ratio among other things. But if the financial guarantor of FHA loans is saying they'll write the loan guarantee with such a bridge loan in place, who are the lenders (whose profit making loans are being guaranteed) to argue? The question will be "on what terms will these short term bridge loans be written?"

The new consumer article for today is Buying Real Estate Isn't Simple. You can pretend it's simple, and hope you get outrageously lucky. Or you can prepare and do the work, and come out reliably enough better to more than compensate you. My clients pretty much come from the latter group.

The Best Loans Right NOW

(based upon "average credit", not absolutely perfect credit. People who do have better credit get even better rates)

Conforming Rates

Thirty Year Fixed Rate Loans

4.875% 30 Year fixed rate loan, with NO points (discount or origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $400,000 loan, Payment $2116, APR 4.914! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate loans as low as 3.75 percent (But you'd have to be crazy to pay that many points!)

5/1 Hybrid ARM Rates

5/1 ARMs have now fallen to levels below 30 year fixed by about half a percent!

4.25% 5/1 ARM, with NO POINTS (discount or origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $400,000 loan, Payment $1968, APR 4.288! This is a fully amortized thirty year loan with the interest rate fixed for five years. 5/1 ARM rates as low as 2.75 percent (But you'd have to be crazy to pay that many points!)

Jumbo Conforming Rates (aka Super Conforming)

(NOW $417,001 to $697,500 in San Diego))

4.75% 30 Year fixed rate loan, with one point (total discount and origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $500,000 loan, Payment $2608, APR 4.876! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate loans as low as 3.875 percent (But you'd have to be crazy to pay that many points!)

VA Rates

4.5% 30 Year fixed rate loan, with one point (total discount and origination) from the lender to the consumer and NO PREPAYMENT PENALTIES (Standard Veterans Administration government generated charges to borrowers apply)!. Assuming a $400,000 loan, Payment $2027, APR 4.625! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate VA loans as low as 4.00 percent (But you'd have to be crazy to pay that many points!)

NONCONFORMING ("JUMBO") RATES

(NOW $697,501 and above in San Diego)

These numbers assume a 70% loan to value ratio, not 80.

Thirty Year Fixed Rate Loans

5.875% "Jumbo" 30 Year fixed rate loan, with ONE point total discount and origination, and NO PREPAYMENT PENALTIES!. Assuming a $700,000 loan, Payment $4141, APR 6.002! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! Jumbo 30 year fixed rate loans as low as 4.75 percent (But you'd have to be crazy to pay that many points!)

5/1 Hybrid ARM Rates

JUMBO 5/1s are a full percent lower than 30 year fixed

4.75% "Jumbo" 5/1 ARM, with one point total discount and origination, and NO PREPAYMENT PENALTIES!. Assuming a $700,000 loan, Payment $3651, APR 4.869! This is a fully amortized thirty year loan with the interest rate fixed for five years. 5/1 Jumbo ARMs as low as 3.625 percent (But you'd have to be crazy to pay that many points!) On the hypothetical $700,000 loan, a 5/1 saves over $650 per month in cost of interest over a thirty year fixed!

All rates above are intended for San Diego County today, and include a 30 day lock. Loan prices will vary every day. Loan pricing in the rest of California will be similar. Conforming loan pricing will be similar between about $150,000 and the conforming limit in your area. Nonconforming loan pricing will be similar from the conforming limit up to about $1 million dollars in loan amount.

10 year interest only payments available on 30 year fixed rate loans!

Great Rates on super-jumbo loans also available!

Zero closing costs and zero points loans also available!

Portfolio lenders! Need something special most lenders can't do? Portfolio lenders may be the key! I have portfolio lenders!

Yes, I still have low to zero down payment purchase and some stated income programs available!

These are actual retail rates at actual costs available to real people with average credit scores! I always guarantee the loan type, rate, and total cost as soon as I have enough information from you to lock the loan (subject to underwriting approval of the loan). I pay any difference, not you. If your loan provider doesn't do this, you need a new loan provider!

All of the above loans are on approved credit, not all borrowers will qualify, based upon an 80% loan to value and a median credit score on a full documentation loan. Rates subject to change until rate lock.

Interest only, stated income, bad credit and other options also available. If you need a mortgage, chances are I can do it faster and on better terms than you'll actually get from anyone else in the business.

Designing transactions for low to zero down payment a specialty

Please ask me about first time buyer programs, including the Mortgage Credit Certificate, which gives you a tax credit for mortgage interest, and can be combined with any of the above loans!

Ask about the 105% refinance with no PMI

Call me. Clarion Mortgage Capital at 619-300-7425, ask for Dan. Or email me: danmelson (at) danmelson (dot) com

The new consumer article for today is Restricted Sale Property: Very Difficult to Find A Loan. Before you make an offer on restricted sale property, know that your financing options are going to be very limited, and being able to refinance may not happen at all. It can still be very worthwhile to own such a property, but this is something you need to know.

I did a bonus article HR 1728: Proof That This Congress Is In the Pockets of Big Banks

I strongly urge you to read it and contact your Senator (the House has already passed it) and urge a "no" vote.

I personally would probably benefit in the short term. But consumers will suffer horribly.

I had intended to host this over at Searchlight Crusade, same as the last two times I hosted, but the folks over at carnivalofrealestate.com posted it as being here, so I'm just going to run with it.

One thing I should say is that while I found some entries worthy of inclusion, there wasn't one I could in clear conscience name my Editor's Pick as best entry of the carnival. Therefore, I must state that THERE IS NO EDITOR'S PICK FOR THIS CARNIVAL.

Nor was there such a preponderance of spam, link spam and just plain old naked solicitation the last two times I hosted the carnival. Here's a hint, or a clue: If you're submitting more than one (or at the very most, two) submissions to the same edition of the same carnival, that's a problem, all by itself. I got five or more submissions from two individuals - eleven from one. I should have just automatically rejected them, but I did them the courtesy of looking at every one of their submissions. I needn't have bothered; it was a complete waste of my time. Kind of like the old hunter's maxim "one shot - one deer. Two shots - maybe one deer. Three shots (or more) - no deer"

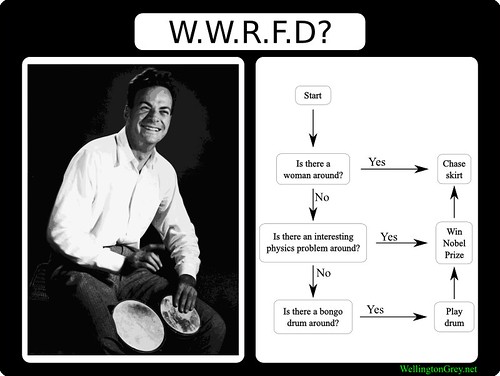

I checked "This day in history" for May 11th for inspiration, and discovered that on this day in 1918 Richard Feynman was born, and so to his memory and guiding premise I dedicate this carnival. I think the quintessential Richard Feynman Image I was able to find was this one:

A good professional of any sort should have a lot in common with Mr. Feynman. Not necessarily his personal life, which while highly amusing benefitted from a certain lack of political correctness, but the intellectual honesty and rigor with which he pursued his profession are an example to us all to be the best we can be.

In 1974 Feynman delivered the Caltech commencement address on the topic of cargo cult science, which has the semblance of science but is only pseudoscience due to a lack of "a kind of scientific integrity, a principle of scientific thought that corresponds to a kind of utter honesty" on the part of the scientist. He instructed the graduating class that "The first principle is that you must not fool yourself--and you are the easiest person to fool. So you have to be very careful about that. After you've not fooled yourself, it's easy not to fool other scientists. You just have to be honest in a conventional way after that.

Buying a Foreclosed Home is a basic article on buying lender owned property.

An Auction Experience to Remember. I'm going to include it as a teaching experience, because I'm willing to bet money he got taken. If you can't spot half a dozen errors deadly to an real estate buyer, you're not trying.

Feynman has been called the "Great Explainer". He gained a reputation for taking great care when giving explanations to his students and for assigning himself a moral duty to make the topic accessible. His guiding principle was that if a topic could not be explained in a freshman lecture it was not yet fully understood. Feynman gained great pleasure[12] from coming up with such a "freshman-level" explanation, for example, of the connection between spin and statistics. What he said was that groups of particles with spin 1/2 "repel", whereas groups with integer spin "clump". This was a brilliantly simplified way of demonstrating how Fermi-Dirac statistics and Bose-Einstein statistics evolved as a consequence of studying how fermions and bosons behave under a rotation of 360°. This was also a question he pondered in his more advanced lectures and to which he demonstrated the solution in the 1986 Dirac memorial lecture.[13] In the same lecture he further explained that antiparticles must exist since if particles only had positive energies they would not be restricted to a so-called "light cone". He opposed rote learning or unthinking memorization and other teaching methods that emphasized form over function. He put these opinions into action whenever he could, from a conference on education in Brazil to a State Commission on school textbook selection. Clear thinking and clear presentation were fundamental prerequisites for his attention. It could be perilous even to approach him when unprepared, and he did not forget the fools or pretenders.[14]

From my other site, Shopping For The Best Loan In The New Lending Environment

Feynman was requested to serve on the Presidential Rogers Commission which investigated the Challenger disaster of 1986. Feynman devoted the latter half of his book What Do You Care What Other People Think? to his experience on the Rogers Commission, straying from his usual convention of brief, light-hearted anecdotes to deliver an extended and sober narrative. Feynman's account reveals a disconnect between NASA's engineers and executives that was far more striking than he expected. His interviews of NASA's high-ranking managers revealed startling misunderstandings of elementary concepts.

Cheap Housing Option: Buy A Mobile Home! is a significantly one sided, and doesn't cover a lot of the downsides of mobile homes. For one thing, the financing options tend to be nightmares. He claims $300 for space rental including utilities; I haven't heard of one under $500, not including utilities, in years. In many locations, Mobile Home Parks are in the process of closing - being winnowed out by better uses for the land that bring the owners more money. It commits that cardinal sin of real estate investing: putting yourself in someone else's control, and in this case, it's not even someone with the same financial incentives your have.

Feynman was sought out by physicist Niels Bohr for one-on-one discussions. He later discovered the reason: most physicists were too in awe of Bohr to argue with him. Feynman had no such inhibitions, vigorously pointing out anything he considered to be flawed in Bohr's thinking. Feynman said he felt as much respect for Bohr as anyone else, but once anyone got him talking about physics, he would become so focused he forgot about social niceties.

National Market Continues to Drop; Some Markets Showing First Signs of Slowing Decline. I don't know why people obsess about after-the-fact statistics that don't even paint an accurate picture of the market when they need reliable methods of prediction to do any good, but they do.

In 1965, Feynman was appointed a foreign member to the Royal Society. [21]At this time, in the early 1960s Feynman exhausted himself by working on multiple major projects at the same time, including his Feynman Lectures on Physics: while at Caltech, Feynman was asked to "spruce up" the teaching of undergraduates. After three years devoted to the task, he produced a series of lectures that would eventually become the Feynman Lectures on Physics, one reason that Feynman is still regarded as one of the greatest teachers of physics. He wanted a picture of a drumhead sprinkled with powder to show the modes of vibration at the beginning of the book. Outraged by many rock and roll and drug connections that one could make from the image, the publishers changed the cover to plain red, though they included a picture of him playing drums in the foreword. Feynman later won the Oersted Medal for teaching, of which he seemed especially proud.[22] His students competed keenly for his attention; he was once awakened when a student solved a problem and dropped it in his mailbox; glimpsing the student sneaking across his lawn, he could not go back to sleep, and he read the student's solution. The next morning his breakfast was interrupted by another triumphant student, but Feynman informed him that he was too late.

Sadie's Take on Delaware sends us Controlling My Credit Score in Delaware Actually, they vary from 350 to 850 in the case of housing credit reports, but otherwise an informative article.

I was unable to discover a schedule of who is the next host (UPDATE: The host will be Minnesota Investment Property Blog, but Carnival of Real Estate will return next week (Monday, May 18th 2009). submit an article here

The new consumer article for today is You Want an Agency That Can Pay ENOUGH Attention to YOU. It really doesn't benefit you to list with an agency that is too busy to pay proper attention to your property, nor does it do any good to use such as a buyer's agency.

There is a major difference between the questions "Who sells the most real estate?" and "Who gets the best price for the quickest sale with the fewest problems?" and an even larger difference between the answers.

(Yes, I know I've been lagging on new articles. I'm busy, and that's mostly a good thing. But at least I got this list up "day of")

These are newly listed HOMESTEPS properties from Freddie Mac for the areas I work. These properties qualify for special financing.

I also have a list of upcoming HOMESTEPS properties not on the market yet

If you have questions, Contact me

La Mesa

Address: 4800 WILLIAMSBURG LN 223, LA MESA, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 185,500.00

Address: 3920 MASSACHUSETTS AVE, LA MESA, CA

Rooms: 5 Bed: 2 Bath: 1.0 Price: 279,900.00

El Cajon

Address: 12074 CALLE DE LEON # 51, EL CAJON, CA

Rooms: 4 Bed: 2 Bath: 2.5 Price: 206,647.00

Address: 754 ALVEDA AVE, EL CAJON, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 268,180.00

Address: 589 NORTH JOHNSON AVENUE UNIT, EL CAJON, CA

Rooms: 5 Bed: 2 Bath: 2.0 Price: 87,450.00

Address: 470 EL MONTE RD, EL CAJON, CA

Rooms: 4 Bed: 2 Bath: 1.0 Price: 169,900.00

Lakeside

Address: 9717 WINTERGARDENS BLVD192, LAKESIDE, CA

Rooms: 3 Bed: 1 Bath: 1.0 Price: 55,120.00

Address: 12923 MAPLEVIEW ST, LAKESIDE, CA

Rooms: 4 Bed: 2 Bath: 1.0 Price: 63,500.00

Santee

Address: 9139 FANITA RANCHO ROAD, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 1.0 Price: 206,700.00

Address: 7390 OLD MISSION COURT 169, SANTEE, CA

Rooms: 4 Bed: 2 Bath: 2.0 Price: 204,050.00

Address: 10210 PALM GLEN DRIVE 73, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 2.5 Price: 237,440.00

Address: 10507 FLORA AZALEA COURT, SANTEE, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 332,500.00

San Diego City

Address: 5252 ORANGE AVE 332, SAN DIEGO, CA

Rooms: 3 Bed: 1 Bath: 1.0 Price: 66,500.00

Address: 6302 LAKE ALTURAS AVENUE, SAN DIEGO, CA

Rooms: 6 Bed: 3 Bath: 2.0 Price: 309,520.00

Address: 6331 LAKE ALTURAS AVE, SAN DIEGO, CA

Rooms: 5 Bed: 3 Bath: 2.0 Price: 333,370.00

Dan Melson, Agent

Clarity Real Estate Network

619-300-7425

The Best Loans Right NOW

(based upon "real people credit", not absolutely perfect credit)

Conforming Rates

Thirty Year Fixed Rate Loans

4.875% 30 Year fixed rate loan, with NO points (discount or origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $400,000 loan, Payment $2116, APR 4.914! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate loans as low as 3.75 percent (But you'd have to be crazy to pay that many points!)

5/1 Hybrid ARM Rates

5/1 ARMs have now fallen to levels below 30 year fixed by about half a percent!

4.125% 5/1 ARM, with NO POINTS (discount or origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $400,000 loan, Payment $1938, APR 4.163! This is a fully amortized thirty year loan with the interest rate fixed for five years. 5/1 ARM rates as low as 3.00 percent (But you'd have to be crazy to pay that many points!)

Jumbo Conforming Rates (aka Super Conforming)

(NOW $417,001 to $697,500 in San Diego))

4.75% 30 Year fixed rate loan, with one point (total discount and origination) to the consumer and NO PREPAYMENT PENALTIES!. Assuming a $500,000 loan, Payment $2646, APR 5.002! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate loans as low as 3.875 percent (But you'd have to be crazy to pay that many points!)

VA Rates

4.5% 30 Year fixed rate loan, with one point (total discount and origination) from the lender to the consumer and NO PREPAYMENT PENALTIES (Standard Veterans Administration government generated charges to borrowers apply)!. Assuming a $400,000 loan, Payment $2027, APR 4.625! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! 30 year fixed rate VA loans as low as 4.00 percent (But you'd have to be crazy to pay that many points!)

NONCONFORMING ("JUMBO") RATES

(NOW $697,501 and above in San Diego)

These numbers assume a 70% loan to value ratio, not 80.

Thirty Year Fixed Rate Loans

5.75% "Jumbo" 30 Year fixed rate loan, with ONE point total discount and origination, and NO PREPAYMENT PENALTIES!. Assuming a $700,000 loan, Payment $4085, APR 5.876! This is a thirty year fixed rate loan. The payment and interest rate will stay the same on this loan until it is paid off! Jumbo 30 year fixed rate loans as low as 4.75 percent (But you'd have to be crazy to pay that many points!)

5/1 Hybrid ARM Rates

JUMBO 5/1s are a full percent lower than 30 year fixed

4.75% "Jumbo" 5/1 ARM, with one point total discount and origination, and NO PREPAYMENT PENALTIES!. Assuming a $700,000 loan, Payment $3651, APR 4.869! This is a fully amortized thirty year loan with the interest rate fixed for five years. 5/1 Jumbo ARMs as low as 3.75 percent (But you'd have to be crazy to pay that many points!) On the hypothetical $700,000 loan, a 5/1 saves over $500 per month in cost of interest over a thirty year fixed!

All rates above are intended for San Diego County today, and include a 30 day lock. Loan prices will vary every day. Loan pricing in the rest of California will be similar. Conforming loan pricing will be similar between about $150,000 and the conforming limit in your area. Nonconforming loan pricing will be similar from the conforming limit up to about $1 million dollars in loan amount.

10 year interest only payments available on 30 year fixed rate loans!

Great Rates on super-jumbo loans also available!

Zero closing costs and zero points loans also available!

Portfolio lenders! Need something special most lenders can't do? Portfolio lenders may be the key! I have portfolio lenders!

Yes, I still have low to zero down payment purchase and some stated income programs available!

These are actual retail rates at actual costs available to real people with average credit scores! I always guarantee the loan type, rate, and total cost as soon as I have enough information from you to lock the loan (subject to underwriting approval of the loan). I pay any difference, not you. If your loan provider doesn't do this, you need a new loan provider!

All of the above loans are on approved credit, not all borrowers will qualify, based upon an 80% loan to value and a median credit score on a full documentation loan. Rates subject to change until rate lock.

Interest only, stated income, bad credit and other options also available. If you need a mortgage, chances are I can do it faster and on better terms than you'll actually get from anyone else in the business.

Designing transactions for low to zero down payment a specialty

Please ask me about first time buyer programs, including the Mortgage Credit Certificate, which gives you a tax credit for mortgage interest, and can be combined with any of the above loans!

Ask about the 105% refinance with no PMI

Call me. Clarion Mortgage Capital at 619-300-7425, ask for Dan. Or email me: danmelson (at) danmelson (dot) com

Buy My Science Fiction Novels!

Dan Melson Amazon Author Page

Dan Melson Author Page Books2Read

Links to free samples here

The Man From Empire

Man From Empire Books2Read link

A Guardian From Earth

Guardian From Earth Books2Read link

Empire and Earth

Empire and Earth Books2Read link

Working The Trenches

Working the Trenches Books2Read link

Rediscovery 4 novel set

Rediscovery 4 novel set Books2Read link

Preparing The Ground

Preparing the Ground Books2Read link

Building the People

Building the People Books2Read link

Setting The Board

Setting The Board Books2Read link

Moving The Pieces

Moving The Pieces Books2Read link

The Invention of Motherhood

Invention of Motherhood Books2Read link

The Price of Power

Price of Power Books2Read link

The End Of Childhood

The End of Childhood Books2Read link

The Fountains of Aescalon

The Fountains of Aescalon Books2Read link

The Monad Trap

The Monad Trap Books2Read link

The Gates To Faerie

The Gates To Faerie Books2Read link

Gifts Of The Mother

Gifts Of The Mother Books2Read link

The Book on Mortgages Everyone Should Have!

What Consumers Need To Know About Mortgages

What Consumers Need to Know About Mortgages Books2Read

The Book on Buying Real Estate Everyone Should Have

What Consumers Need To Know About Buying Real Estate

What Consumers Need to Know About Buying Real Estate Books2Read